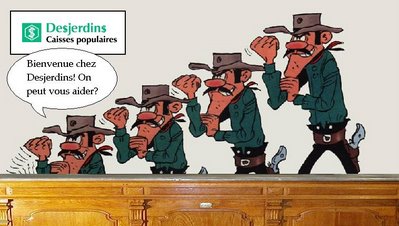

People my age probably remember the ubiquitous Desjardins, already in grade school. Art Contest sponsored, school fund (this is important to spare!) etc.. It idealizes the body, it tells the story of Alphonse Desjardins in a cartoon in the newspaper, we are told that before the credit unions, Quebecers were rotten economy, but thanks to them, Quebecers have become Leaders savings and finance (???). Whatever we were able to send flowers, it is clear that the institution is not what it was. Alphonse should even be turning in his grave. We are entitled to ask questions to the demagoguery and the current practices of what was once called a cooperative.

People my age probably remember the ubiquitous Desjardins, already in grade school. Art Contest sponsored, school fund (this is important to spare!) etc.. It idealizes the body, it tells the story of Alphonse Desjardins in a cartoon in the newspaper, we are told that before the credit unions, Quebecers were rotten economy, but thanks to them, Quebecers have become Leaders savings and finance (???). Whatever we were able to send flowers, it is clear that the institution is not what it was. Alphonse should even be turning in his grave. We are entitled to ask questions to the demagoguery and the current practices of what was once called a cooperative. The National cooperatism

Everyone knows that a bank is a "mean" private enterprise. Since Quebec is left self-proclaimed alternative Desjardins and defender of the people posing as a cooperative. We must be honest, this was the case initially. They were really the members who made decisions and being a member meant something. And now? Desjardins is "a bank like the others." Most members do not receive an invitation (one of my colleagues told me that he never received any information to this effect for 12 years) and assemblies are not quite shown. Decisions are made in haste. For those who have been in a meeting, you surely remember the expeditious manner in which the "debates" are animated. Already, we do not say too much about the whys and wherefores of a situation and the reasons why the board of directors of a union to take action. That is: "Look, we want to do that. Questions? No? Then it passed! . Nobody dares to come forward as they have not enough information to get points or alternatives. Anyway, the reality, I will tell you (and besides, a senior officer of a credit union has confessed to one of my colleagues): decisions are taken by the federation and the unions must apply. However, unions have a duty to swallow and endorsed by its members. Yes sir, yes ma'am, it's called a co-op!

But however, it is incredible how this institution is praised and played the nationalist card to the max! Desjardins describes itself as one (or even LA) pride of Quebec entrepreneurship. In short, I'm shocked every time the average Quebecer is left blind and ultimately be fooled by anyone acting on his little nerve. People follow, blinded or hypnotized! Wake up! You get fucked! Get fucked by a Quebec company or a company for that matter, it remains that it is to get fucked anyway and you will never see again your money! Certainly, the issue of sacred cows of Quebec nationalism is an interesting topic for further investigation. Anyway, back on topic.

Bank charges are truly become a plague in the banking world, and Desjardins there is certainly no exception. In fact, everything is computerized. Unions merge to save costs. 20 years ago, unions have pushed consumers to obtain debit cards, saying at the time that it was free! Now that people have become "addicted" (for we must admit, it is convenient Interac card), Desjardins closes the cage lobsters and traps the consumer with costs still higher, year after year. This is one situation that was raised by the group "Option-consumer", following the announcement Desjardins increase of $ 1,000 to $ 5,000 minimum monthly balance to enjoy a free pass. Question: Given that profits Desjardins are comparable to those of major banks, is it really necessary to charge? For those who took the time to review the financial statements of a union, they will see not. Unions are already profitable without the expense. The trick? Probably lull members into giving them more discounts? A simple mathematical calculation for everyone is enough to reach the conclusion that, as calculated by the cash rebate a small percentage of the fees paid by the user (and not all), the latter will always lose out.

Besides, let's talk about the alleged kickbacks. Each spring, Desjardins announces with great advertising costs that the cooperative will pay approximately $ 600 million in rebates (which represents less than a fifth of annual profits. Balance? Probably in the pockets of administrators!). There are about 3 million members of credit unions. A little calculation shows that on average, each member receives a $ 200 rebate per year. In fact, some colleagues have shown their statement indicates they have received about $ 0.50 rebate annually. Again, where is the balance? I prefer not to think about. Yet this has not prevented a completely silly TV ads in 2002 or 2003, a man who embraced the ATM after the filing of his famous rebate. This has also followed the big-budget color brochures with statements like: "With my discount, I'll travel this year," "With my discount, I pay my student loan," "I invested my rebate in my RRSP. Certainly, there are those who have ambition, with their roughly 50 cents! What is even more absurd is that the banks have all created in recent years (still on the order of the federation) a special reserve, capitalized interest, to give some more discounts during the lean years ! I leave you free to your conclusions ...

Before you criticize me of being "whiners" and not being constructive, I want to tell you that I have a solution for you! The fund could reduce costs and decrease proportionally to nothing rebates.

1) The body gets a tremendous competitive advantage and can boast of being the only financial institution without cost, and so people garrocha home;

2) A credit to members says that thus, they are winners (vs. fee rebates) and they will no longer lose money unnecessarily;

3) Because each box has a special fund discount, the member will still have some money (as is the case now), maybe a little more depending on the year. Mind you, the banks do not give refunds. Then the funds will still have a competitive advantage!

Unfortunately, it's a pipe dream to believe that it could happen. If instead you believe, so hurry to go to your meetings and offer the cash alternative.

In sum, the fund, by its claim to be a cooperative and its abuse of nationalism is neither more nor less than the Soviet penchant of modern banking. It is fine to call it a cooperative, the member did, in fact, very little power except that of being the architect of his own misfortune. Moreover, as the Soviet Union, dissidents who dare to stand up and speak against the fund to the General Assembly that have problems later.

Stay tuned!

0 comments:

Post a Comment